Globalization Partners: Revolutionizing Global Payroll Management

In today’s interconnected world, businesses are increasingly expanding their operations across borders, tapping into diverse talent pools and new markets. However, managing payroll for a global workforce presents a unique set of challenges. From navigating complex tax laws and regulations to ensuring accurate and timely payments in multiple currencies, international payroll management can be a daunting task for even the most seasoned businesses.

This is where Globalization Partners (G-P) steps in, offering a comprehensive solution to revolutionize global payroll management. With a presence in over 180 countries, G-P empowers businesses to streamline their payroll processes, ensure compliance, and mitigate risks, allowing them to focus on their core operations and growth objectives.

This article delves deep into the intricacies of global payroll management and how G-P’s innovative solutions are transforming the way businesses pay their international employees.

1. The Complexities of Global Payroll Management: A Multifaceted Challenge

Managing payroll for a global workforce is far more complex than simply replicating domestic payroll processes in different countries. Businesses must navigate a myriad of challenges, including:

- Varying Labor Laws and Regulations: Each country has its own unique set of labor laws and regulations governing employment, taxation, and payroll. Staying abreast of these ever-changing laws and ensuring compliance can be a significant burden for businesses.

- Complex Tax Systems: International payroll involves navigating complex tax systems, including income tax, social security contributions, and other payroll taxes. Calculating and withholding the correct taxes in each country requires specialized expertise and meticulous attention to detail.

- Multiple Currencies and Exchange Rates: Paying employees in different countries involves managing multiple currencies and fluctuating exchange rates. This can create complexities in budgeting, forecasting, and ensuring accurate and timely payments.

- Data Privacy and Security: Protecting sensitive employee data, such as personal information and financial records, is crucial in international payroll management. Businesses must comply with data privacy regulations in each country, which can vary significantly.

- Cultural and Language Differences: Managing a global workforce requires sensitivity to cultural and language differences. This includes understanding local customs, holidays, and communication styles, which can impact payroll processes and employee expectations.

- Technology and Infrastructure: Implementing and maintaining the necessary technology and infrastructure to support global payroll can be a significant investment for businesses. This includes payroll software, payment systems, and data security measures.

2. Globalization Partners (G-P): Simplifying Global Payroll Management

Globalization Partners (G-P) offers a comprehensive solution to simplify and streamline global payroll management. Their expertise in international employment law, combined with their robust technology platform and dedicated customer support, makes them a valuable partner for businesses seeking to manage their global workforce effectively.

Key Features of G-P’s Global Payroll Solutions:

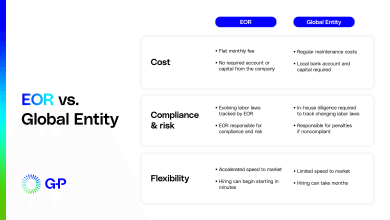

- Global Employer of Record (EOR) Model: G-P’s EOR model allows businesses to hire employees in foreign countries without establishing legal entities. G-P acts as the Employer of Record, handling all employment-related responsibilities, including payroll, benefits, compliance, and risk management.

- Multi-country Payroll Processing: G-P handles payroll processing in over 180 countries, ensuring compliance with local tax laws and regulations. Their in-country experts possess deep knowledge of local payroll requirements, ensuring accurate and timely payments.

- Currency Conversion and International Payments: G-P facilitates seamless currency conversion and international payments, ensuring timely and accurate compensation for employees in their local currency.

- Tax Filing and Reporting: G-P manages tax filing and reporting obligations in each country, relieving businesses of the administrative burden and minimizing the risk of penalties.

- Benefits Administration: G-P manages employee benefits programs, including health insurance, retirement plans, and other statutory benefits, ensuring compliance with local regulations and employee expectations.

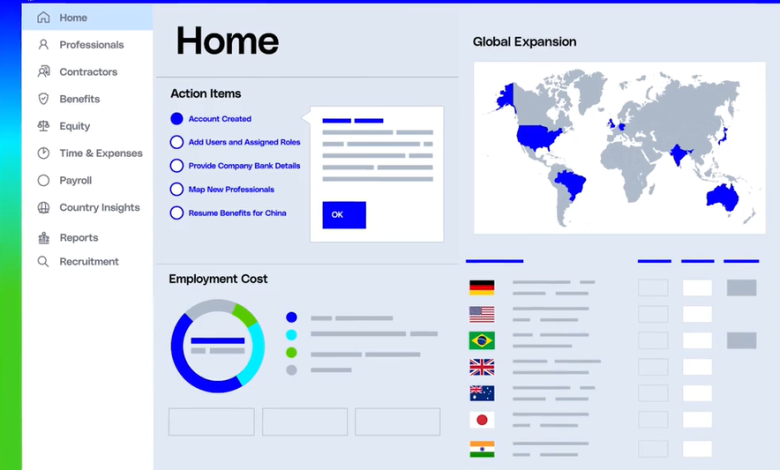

- Technology Platform: G-P’s technology platform, the G-P Meridian Suite™, provides a centralized hub for managing global payroll, benefits, and compliance. It offers real-time visibility into payroll data, automated workflows, and reporting capabilities.

- Dedicated Customer Support: G-P provides dedicated customer support to assist businesses with their global payroll needs. Their team of experts is available to answer questions, resolve issues, and provide guidance on navigating the complexities of international payroll.

3. The Benefits of G-P’s Global Payroll Solutions

By leveraging G-P’s comprehensive global payroll solutions, businesses can realize a range of benefits:

- Reduced Costs: G-P’s solutions can help businesses reduce payroll processing costs by eliminating the need for manual processes, multiple payroll systems, and in-house expertise.

- Improved Compliance: G-P ensures compliance with local labor laws and tax regulations, minimizing the risk of penalties and reputational damage.

- Enhanced Efficiency: G-P’s technology platform and streamlined processes improve efficiency and productivity, freeing up internal resources for strategic initiatives.

- Increased Accuracy: G-P’s expertise and technology ensure accurate payroll calculations and payments, minimizing errors and ensuring employee satisfaction.

- Improved Employee Experience: G-P’s solutions provide a seamless and positive payroll experience for employees, with timely payments, accurate benefits administration, and clear communication.

- Focus on Core Business: By outsourcing global payroll management to G-P, businesses can focus on their core competencies and growth objectives.

4. G-P’s Global Payroll Solutions in Action: Real-World Examples

- A technology company expanding into Asia leveraged G-P’s EOR solution to hire and pay employees in multiple countries without setting up local entities. G-P handled all payroll processing, tax compliance, and benefits administration, allowing the company to focus on its core business of developing innovative software solutions.

- A retail company with a global presence used G-P’s global payroll solutions to streamline its payroll processes and ensure compliance with local regulations in different countries. G-P’s technology platform provided real-time visibility into payroll data, allowing the company to track costs and identify areas for improvement.

- A manufacturing company expanding into Latin America used G-P’s services to navigate the complexities of local labor laws and tax regulations. G-P’s in-country experts ensured compliance and minimized risks, allowing the company to focus on establishing its manufacturing operations.

5. The Future of Global Payroll Management: Trends and Predictions

- Increased Automation: Automation will continue to play a crucial role in global payroll management, streamlining processes and improving efficiency.

- Enhanced Data Analytics: Data analytics will provide businesses with deeper insights into their global payroll data, enabling them to make informed decisions about their workforce and compensation strategies.

- Focus on Employee Experience: Businesses will prioritize the employee experience in payroll management, ensuring timely and accurate payments, transparent communication, and easy access to payroll information.

- Globalization Partners (G-P) at the Forefront: G-P will continue to innovate and expand its services to meet the evolving needs of businesses in the global marketplace, leading the way in revolutionizing global payroll management.

Conclusion

Globalization Partners (G-P) offers a comprehensive solution to revolutionize global payroll management. Their expertise in international employment law, combined with their robust technology platform and dedicated customer support, makes them a valuable partner for businesses seeking to manage their global workforce effectively.

By leveraging G-P’s global payroll solutions, businesses can:

- Simplify global payroll management: Eliminate the complexities and costs associated with managing payroll in multiple countries.

- Ensure compliance: Mitigate legal risks and protect their reputation by complying with local labor laws and tax regulations.

- Improve efficiency: Streamline payroll processes and free up internal resources for strategic initiatives.

- Increase accuracy: Ensure accurate payroll calculations and payments, minimizing errors and ensuring employee satisfaction.

- Enhance employee experience: Provide a seamless and positive payroll experience for employees.

- Focus on core business: Delegate global payroll management to G-P and focus on their core competencies and growth objectives.

As the world becomes increasingly interconnected, G-P’s role in facilitating global expansion and supporting businesses on their journey to international success will only become more significant. Their innovative solutions and commitment to customer service position them as a leader in the global payroll management space.

This article is intended for informational purposes only and does not constitute legal or financial advice. It’s essential to conduct thorough research and consult with relevant professionals before making any business decisions.